A history of Web2 & intellectual property (IP) rights

The internet we know today has evolved quite some distance from its original iteration, which was initially to build a network for the storage and sharing of information. The interactive nature of the internet that is now so commonplace was never envisaged in the early stages of its development, and its continued expansion towards connectivity has caused a series of headaches when it comes to data protection and intellectual property rights.

The difficulties derive from the data that is created when we use the internet, which is sent to the server of an internet service provider – data which we do not have any ownership over.

To understand how this works in practical terms, we can use social media companies as an example. They use a ‘trust’ model using centralised services, servers and software, which requires users to trust that the companies capturing all of this data will do so responsibly. This is because social media companies built Web2 on top of the existing Web1 infrastructure, so there is no guarantee for content protection against duplication or other forms of IP rights infringements.

Every time we interact on the internet, copies of our data get sent to the server or a service provider and we lose control of our data. Despite being more connected than ever before data is centrally stored. This raises issues of security, privacy and control of personal data and inefficient supply chains. Whilst Web2 platforms created the P2P economy, they also dictate all the rules and they control the data of their users.

Does Web3 offer better intellectual property (IP) protection?

Web3 promises something different, with a focus on decentralisation to improve privacy protection and minimise or remove intellectual property infringements. Also known as the blockchain, Web3 is a readable and writable internet that can help to improve privacy and security, putting end-users in charge. To put it into context, trying to manipulate data on a server resembles breaking into a house secured by a fence, cameras and alarm system. Web3 is designed so that you would need to break into multiple houses at the same time where each has their own fence, cameras and alarm system. It is still possible but highly improbable.

While the Web2 was a front-end revolution, the Web3 is a back-end revolution. It is a set of protocols on a blockchain network or a distributed ledger where no single user controls the data. Decentralised applications run on a P2P network of computers as opposed to centralised applications.

The concept of content ownership and control and intellectual property has been disrupted by the arrival of a decentralised Web3. One of the main flaws with the current IP ownership system is the high costs and complex legal requirements, while it also struggles to fit into a more globalised world.

Web3 offers the option of creating digital timestamps to artistic content and the tracking of subsequent owners. Smart contracts can be used to ensure a fixed percentage of the sales price goes to the creator, every time it is resold.

As a result, assets can be transferred, traded and assigned a financial value, while licensing and contractual processes are reduced as transactions are sent through a shared network.

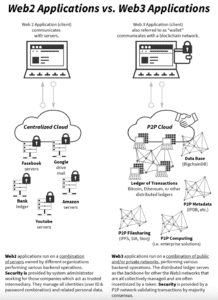

A helpful diagram of Web2 vs. Web3

Diagram: Voshmgir, S. (2020) Token Economy – How the Web3 reinvents the Internet, 2020 2nd edn, pg 36.